Amoco, a name synonymous with innovation and resilience, has a rich history that goes far beyond its recognition in the energy sector. Known initially as the Standard Oil Company of Indiana, Amoco's journey mirrors the evolution of the modern financial services industry, displaying an innate ability to adapt and lead in an ever-changing economic landscape.

The roots of Amoco can be traced back to the late 1800s, a pivotal time when the demand for kerosene and gasoline began to reshape the American economy. Although primarily focused on oil production, Amoco inevitably found itself weaving into the fabric of financial services. As evidenced in its early strategies, Amoco engaged in an array of financial maneuvers, setting foundations for practices that we now recognize as pivotal in today's financial sector.

In its nascent stages, Amoco embraced a culture of financial prudence and strategic foresight. Its ability to predict market trends enabled it to extend its influence beyond energy, venturing into investments and financial asset management. Amoco's financial division started small, initially handling transactions related to its vast network of refineries and distribution channels. However, it soon expanded, providing invaluable insights into managing large-scale financial operations, which inadvertently sparked transformations within the financial sector itself.

One key milestone in Amoco's financial history was during the early 20th century when it played a significant role in fostering bonds and equities. At a time when traditional funding sources were constrained, Amoco explored alternative investments, leveraging its financial acumen to sustain and fuel its growth. This not only bolstered its position in the market but also influenced broader financial practices, serving as a blueprint for managing corporate finances in oil and beyond.

Amoco's innovative spirit was perhaps most notably seen in the 1980s with its involvement in the development of energy futures. This period marked Amoco's transition from a passive participant in the financial world to a pioneering entity driving the market. By utilizing futures contracts, Amoco could hedge its risks, ensuring price stability and securing substantial financial leverage. This approach not only optimized its financial performance but also set precedents in risk management, influencing financial service practices across industries.

In parallel with these accomplishments, Amoco's commitment to sustainability and corporate responsibility laid the groundwork for ethical investment practices. Recognizing the importance of environmental stewardship, Amoco initiated projects and financial models that would later form the basis of socially responsible investing, now a cornerstone in the financial services industry.

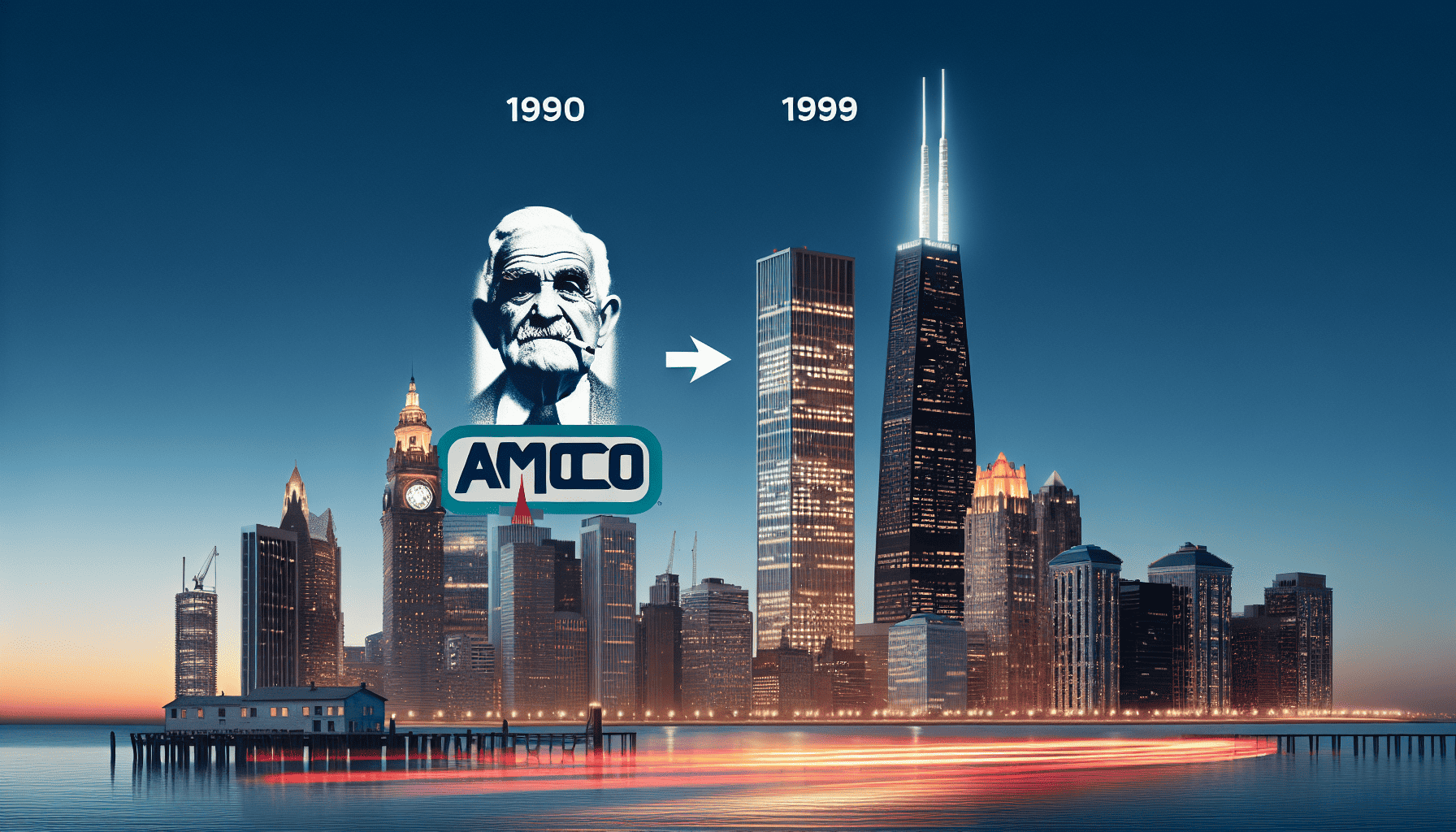

The merger with British Petroleum (BP) in the late 1990s marked another pivotal point in Amoco's history, bringing together financial expertise that would drive further innovation and development in the sector. This partnership enhanced Amoco's global reach and significantly impacted international financial services, opening new avenues for cross-border investments and development financing.

Today, while Amoco as a standalone entity in financial services isn't predominant, its legacy is indelibly etched into the framework of the industry. Its financial strategies, risk management techniques, and commitment to sustainability continue to influence and inspire contemporary financial practices.

The rich history of Amoco serves as a testament to how a company, initially focused on energy, could influence and shape the world of finance. From pioneering investment strategies to leading ethical practices, Amoco's legacy in financial services is one of innovation and leadership, providing a remarkable blueprint that continues to guide and inspire today's financial landscape.